Content

The argument for not doing this is that in a PFI-Model contract other economic-ownership risks are taken by the Project Company, and it is thus similar to an operating lease; but as the discussion below will show, this is a very grey area. It is probably questionable whether a black-and-white decision—on or off the public-sector balance sheet—is appropriate, since it is clear that a PPP involves complex gradations of risk transfer. There is an argument for a more sophisticated approach which reflects this and would divide the balance-sheet recording between public and private sector. Thus, capital regulation is justified as an attempt to correct the market failure that results from banks’ preference for a higher debt/equity ratio than is socially optimal. When reading a balance sheet, a higher stockholder equity is better.

At least 6% of the total capital ratio will need to be made up by Tier 1 capital, of which 4.5% will need to be made up in any case by CET1 capital. The remaining 2% may be completed with Tier 2 capital instruments. The lower the percentage of own resources compared to the total of the balance sheet, the higher the institution’s financial leveraging and the lower the level of protection of the institution against defaults https://www.bookstime.com/articles/financial-statements-for-banks in the loans stated in the assets side. This allowance is a pool of capital specifically set aside to absorb estimated loan losses and should be adequate to absorb the estimated amount of probable losses in the institution’s loan portfolio. More convenient than cash and checks — money is deducted right from your business checking account. Make deposits and withdrawals at the ATM with your business debit card.

Understanding how central banks use their balance sheets: A critical categorisation

Capital, or equity, represents the cushion between a bank’s assets and its liabilities. Consideration of a typical (albeit simplified) bank balance sheet2 is useful in understanding the calculation and regulation of capital (see Figure 8.1). Since the Global Crisis, the size of central bank balance sheets has grown significantly. Traditional goals of price and financial stability are insufficient for assessing the success of modern central banking operations.

- Thus, capital regulation is justified as an attempt to correct the market failure that results from banks’ preference for a higher debt/equity ratio than is socially optimal.

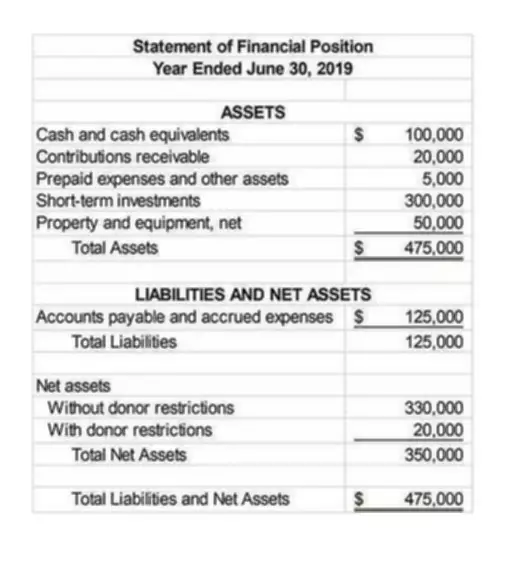

- The balance sheet reports the amounts in the accounts at the end of a period.

- Depository institutions maintain balances on deposit with the Federal Reserve, and these balances are reported in either term deposits held by depository institutions or other deposits held by depository institutions.

- An example of a VIE is an investment fund set up as a limited partnership.

- For the Net Charge-Off Ratio, let’s take the number here and then divide by the average Gross Loan balance.

- Balance sheet totals can also be used when performing any kind of accounting calculations such as accounting ratios or creating projections for your business.

That is, assets always equal the sum of liabilities and net worth. Writing it this way emphasizes that, like borrowings and other liabilities, net worth is a source of funds used to finance assets. We can also think of net worth as the residual that would be left over if an entity were to sell everything it owns and pay off all its debts. Our system of fractional reserve banking is built on the assumption that even on a bad day, on balance, customers typically do not withdraw more than 5 or 10% of deposits. Typically, on an average day, deposits cancel out against withdrawals. The following balance sheet shows a bank with $4,000 of deposits, $400 in total reserves, and $3,600 in loans.

Commercial Banking

With significant assets to collateralize the total amount, they could, if they chose to, convert the LOC to a term loan at any time. Hence some variants of PPP structures just cover the construction phase, with the Facility reverting to public-sector control thereafter (cf. §17.3). Although CDOs are not a recent innovation, the market only experienced high growth rates from 1995 onwards, and certain investors are still prone to regard it as an “emerging” asset class. However in terms of volume in the US market, CDOs are comparable to credit card and automobile loan asset-backed securities, as illustrated in Figure 28.3 below. Second, as discussed previously, part of a bank’s preference for debt stems from the safety net subsidy.

On the other hand, the amortized cost of a loan or debt security has little to do with the asset’s market value. Instead, the amortized cost of a loan (or other debt asset) is just the current outstanding principal of the debt, with minor adjustments for fees on originated loans or premiums/discounts on purchased loans. Historically, balance sheet substantiation has been a wholly manual process, driven by spreadsheets, email and manual monitoring and reporting.

Business Loans

If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. Preparing a balance sheet using spreadsheet software is really the same as preparing a balance sheet manually since you’ll still have to manually enter the totals, just as you did when using the manual method.

The banking industry recognizes different categories of risk, including credit risk, interest rate risk, liquidity risk, compliance risk, even reputation risk. As one of the three main federal banking regulators, the Office of the Comptroller of the Currency has a handy overview of the different kinds of risks. “Total equity https://www.bookstime.com/ capital” consists of shareholder dollars and accumulated profits held by the bank as its capital base. Roughly speaking, bank regulations require banks to have around $1 in equity capital for every $12 in total assets, or a minimum ratio around 8%. M&T Bank’s $24 billion for $200 billion in assets is a ratio of 12%.

Definition of Banks Balance Sheet

The balance sheet provides an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own. For this reason, the balance sheet should be compared with those of previous periods. Clearly marking this information makes it easier for you and any stakeholders to find the balance sheet when you need it and compare it to other financial documents or to balance sheets from other years or quarters.